A loan pipeline software program is a fantastic choice in order to streamline the administration of your loan portfolio. It not only saves time and effort for all businesses involved in loan processing but, it can also help increase accuracy across the board making sure that every transaction is recorded correctly and safely. In addition, technology can be utilized to automatize certain processes, which could drastically reduce the manual labor required for the approval or onboarding of loans. This leads to efficiency that is both advantageous to both lenders and borrowers.

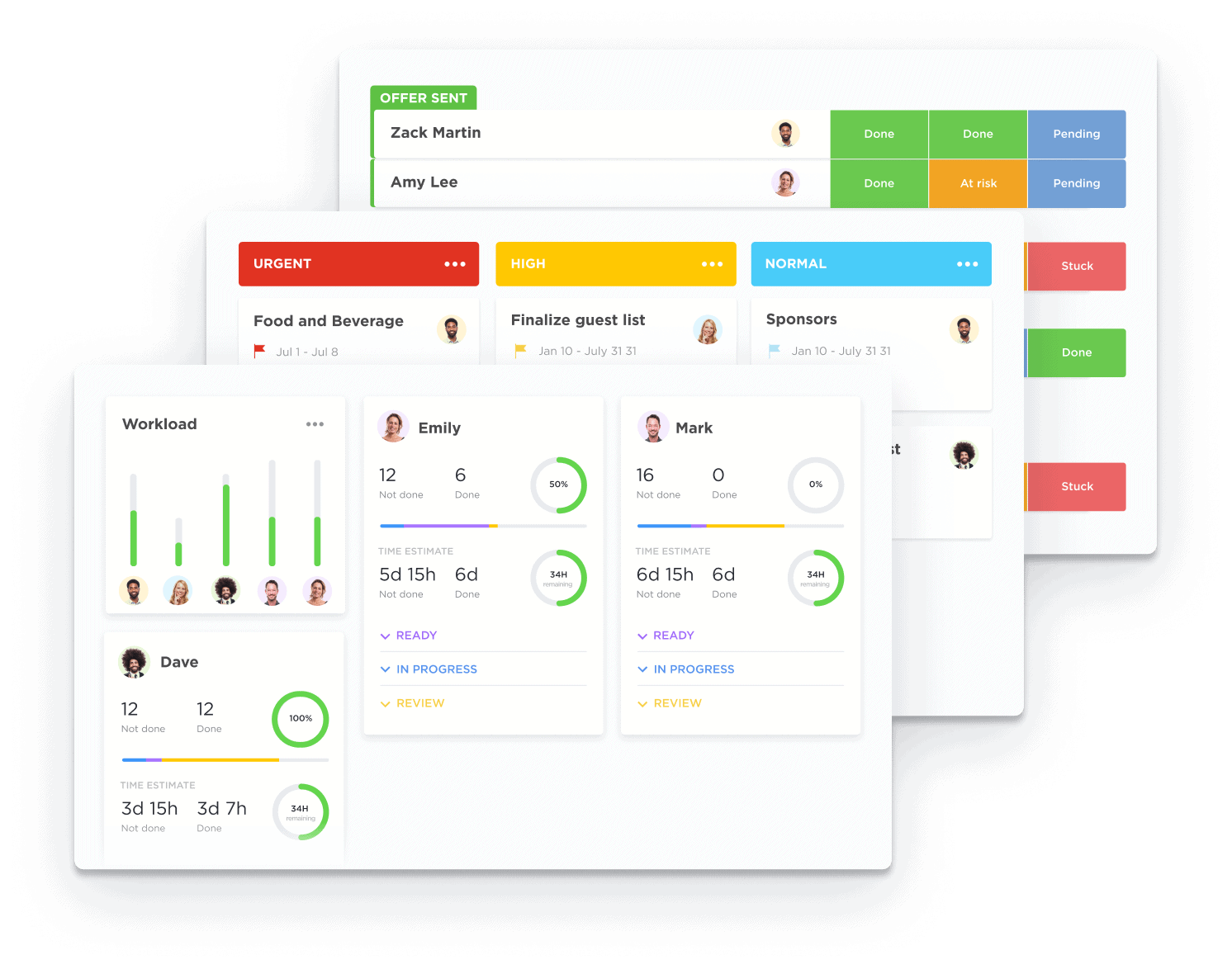

Automated tracking and management solutions ensure that loan transactions go more smoothly, from beginning to end. The precision and efficacy of documents and reports generated by software will ensure that the longevity of a company is longer while saving time and money. Technology can automate specific procedures that are required to onboard, reducing the manual labor required by both the lender and the borrower’s sides. The loan pipeline software is especially useful in improving the management of liquidity. It grants users access to real-time collaboration capabilities and also integrates with data reporting capabilities. Furthermore, using this kind of technology can improve customer service by significantly helping businesses manage their customer relations with friendly customer support tools as well as automated processes including secure document sharing, online payment systems, and more!

For their business to be successful the loan agent must maintain good customer relations and maintain regular communication. Without a dedicated CRM and loan professionals may be unable to keep track of a vast amount of contacts as well as the associated documents, tasks, and other details. A CRM assists in organizing all customer information in one place which allows you to quickly get their contact information as well as quickly send emails or notices, track the progression of loan applications, make your job easier, produce reports, and more. A CRM allows loan officers to simplify their processes, and also provide top-quality service while cutting down on time. Every loan agent who wants to be able to efficiently manage their clients and also close loans is likely to need a CRM.

The software for the loan pipeline is an essential tool for institutions of finance. It allows you to place and send loan orders. It reduces manual processes and increases the accuracy of the pipeline of loans. These benefits go beyond efficiency, as it provides better customer service by providing real-time updates on loan status and assuring the customer that their approvals are completed in a timely manner. It can also help to lower operating costs since mistakes made by hand are reduced and less time is required to perform tasks. Furthermore, this software is customizable based on the organization’s specific preferences regarding communications and data reporting requirements. Organizations can feel confident that transactions are secure from unauthorized access.

Increase efficiency in your company

The software for the loan pipeline is an excellent way for your business to increase efficiency. It is easy to monitor, organize, and control your entire loan process. Automating processes can eliminate the need for manual labor, saving time and cash. Software that automatizes loan application processing will help improve customer service by streamlining the process and speeding up the decision-making process. It also helps decrease human error and offers visibility into all aspects throughout the lifecycle of a loan. This software can give your company a competitive edge in the current market, making it possible to integrate it into your operations.

Simple and cheap

Loan Pipeline Software offers affordable and easy solutions that can help you manage the servicing of your loans. This software has all the tools you need to manage your borrower’s loan details, payment information, and other related documents in one simple platform. Loan Pipeline is especially useful for businesses that have to deal with an enormous amount of data because it permits many users to collaborate with their colleagues across various locations, and allows for flexible access whenever needed. Loan Pipeline Security features help safeguard confidential data from unauthorized access by third parties. These features make Loan Pipeline an ideal choice for those looking for a cost-effective solution without sacrificing security or quality.

You can manage your business anywhere

Software that allows you to manage your loan pipeline has changed how companies manage their business. The loan tracker technology allows you to remotely monitor projects and loans, making it simple to run your business from anywhere in the world. Loan software gives you detailed, real-time information about current clients prospective clients, application development, and performance. With accurate data and valuable insights into your company, you will be able to see important data about your clients that would be difficult to collect manually in a traditional office environment. Loan tracking is an essential tool for entrepreneurs trying to be mobile and responsive regardless of their location. The benefits of loan pipeline software are evident, making it an integral component of any effective loan management system.

For more information, click perfect pipeline management tool